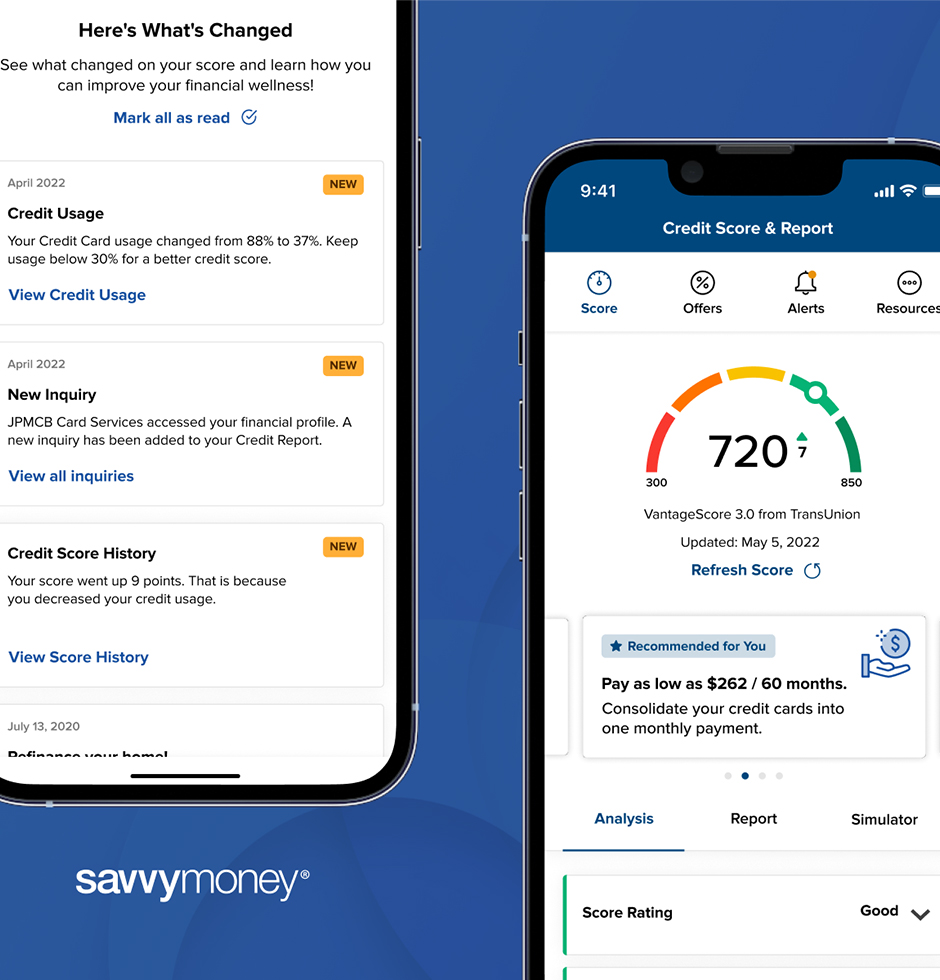

A smarter credit score solution, right within your digital banking app.

Key Features

-

Credit Score Analysis

![]()

-

Full Credit Report

![]()

-

Credit Monitoring

![]()

-

Personalized Offers

![]()

Access your credit score and report, all in one dashboard.

Access a comprehensive credit score analysis, full credit report, monitoring and personalized offers, empowering you to take control of your credit. In addition to receiving support in monitoring your credit and detecting potential fraud, your credit profile delivers personal insights that help you understand the factors that impact your credit score and what can be done to strengthen it. Available 24/7 within digital banking.

Powered by SavvyMoney.

How to Access Your Credit Profile

1. For personal accounts, log into your Seattle Bank online or mobile banking account.

2. Navigate to "Credit Score & Profile" in the sidebar menu.

3. Track your credit score and money saving recommendations.

Frequently Asked Questions

{beginAccordion}

How do I see my credit score in online banking?

The ability to view your credit score and report through our partner SavvyMoney is built into online and mobile banking. Log into your online banking account and access your credit score by clicking on “Credit Score & Profile” in the navigation menu on the left. If it’s your first time to access your profile, you’ll be asked a few first-time visitor questions to verify your identity.

Can I see my credit score anytime and at no cost?

Yes, this feature is free and no credit card information is required to register. You can pull your updated credit score up to every 24 hours. An updated full credit report is available monthly.

Will accessing my credit score via SavvyMoney affect my credit and potentially lower my credit score?

No, checking your SavvyMoney credit score is a soft inquiry, which will not affect your credit score.

What is a credit score?

A credit score is a three-digit number (derived using a mathematical formula) from all the information in your credit report. That mathematical formula is called a credit scoring model which attempts to measure the likelihood that you may default on a loan payment, which is defined as being more than 90 days “past due.” These models analyze various credit behaviors such as how regularly you pay your bills on time. For more information, visit http://www.consumerfinance.gov/askcfpb/315/what-is-my-credit-score.html.

What is VantageScore?

VantageScore was founded by the 3 leading credit reporting companies – Experian, Equifax and TransUnion. The credit score model was developed by a representative team of statisticians, analysts and credit data experts from each of the credit reporting companies, and is used by hundreds of institutions, including credit unions, banks, credit card issuers and mortgage lenders. The VantageScore 3.0 model will range from 300 to 850 – a numerical scale that is more commonly used by other credit scoring models. Higher scores indicate to lenders that you’re a less risky borrower, while lower scores indicate that you’re an increased risk.

What is a credit report?

Credit reports, also known as credit files, are composed of the credit-related data a credit reporting company has gathered about consumers from different sources. Credit reports include records of mortgage payments, credit card balances, credit card payments, auto loan payments and credit inquiries. It may also include public records, such as tax liens and other information from government sources.

What does a good VantageScore credit score mean to me?

A good score may mean you have easier access to more credit, possibly even at lower rates. The consumer benefits of a good credit score go beyond the obvious. For example, underwriting processes that use credit scores allow consumers to obtain credit much more quickly than in the past.

What influences my VantageScore credit score?

How many credit accounts you have, how much have you borrowed, and how promptly have you made your required payments affects your score. These and other key factors influence your credit report, and ultimately your VantageScore credit score.

{endAccordion}